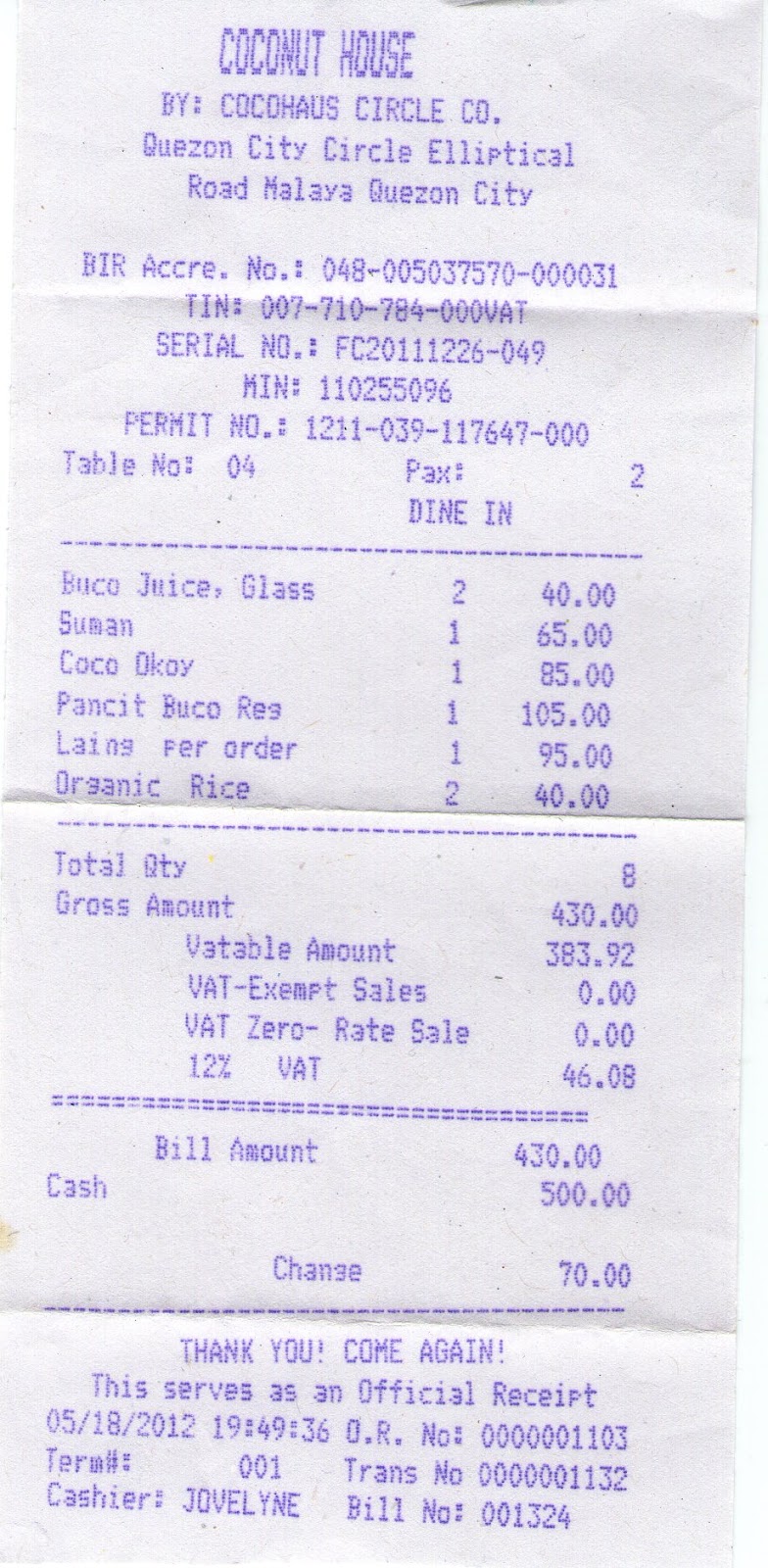

Income reinvested in a business, except for the purchase of real estate, is an allowable business expense. Interest on loans for capital assets or durable goods.Transportation expenses required for employment, and.Salaries for employees other than the client,.Allowable self-employment expenses include, but are not limited to: Subtract from gross self-employment income any allowable business expense necessary and directly related to producing goods or services.Refer to 01.03.02 for other acceptable documentation if the client has not been self-employed long enough to have filed taxes. Personal and business tax returns must be submitted. Net income is obtained from the Federal Income Tax Return (IRS1040)Īnd all applicable schedules and attachments. Income Eligibility for a self-employed client is based on net income. Documentation must be secured for all income and maintained in the family eligibility file prior to approval for child care payments. Two-parent families include those with 2 or more adults living in the home, such as the applicant and his or her spouse or parents of a common child in the home. In 2 parent families, both incomes must be combined to determine eligibility. 01.02.04 - Parent Income Calculation Worksheet (xlsx)Ī family is considered "income eligible" when the combined gross monthly base income (earned and unearned) of all family members is at or below the Maximum Monthly Income Levels for the corresponding family size.For forms and publications, visit the Forms and Publications search tool.Reference: 89 Ill. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La página principal en español (Spanish home page). These pages do not include the Google™ translation application. We translate some pages on the FTB website into Spanish. If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Visit 1099s (information returns) for more information. It reports non-employment income paid to your business during a tax year.Ĭommon income types reported on a 1099 include: 1099s (information returns)Īn information return is a tax document that banks, financial institutions, and other payers send to your business and the IRS. Consider working with a tax professional. Your business may have to report other income types not listed here. Proceeds from a sale of capital assets are a type of gross income. Capital assets can be tangible or intangible property. Most property you own and use for business purposes or investment is a capital asset. Interest and dividends are a type of gross income and should be included in your total income. Rental income from a business is a type of business gross income.

You must pay tax on any profit from renting out property.

Using real property, e.g., apartment, building, etc.Rental income includes money collected by your business, a landlord, from third parties, tenants, for:

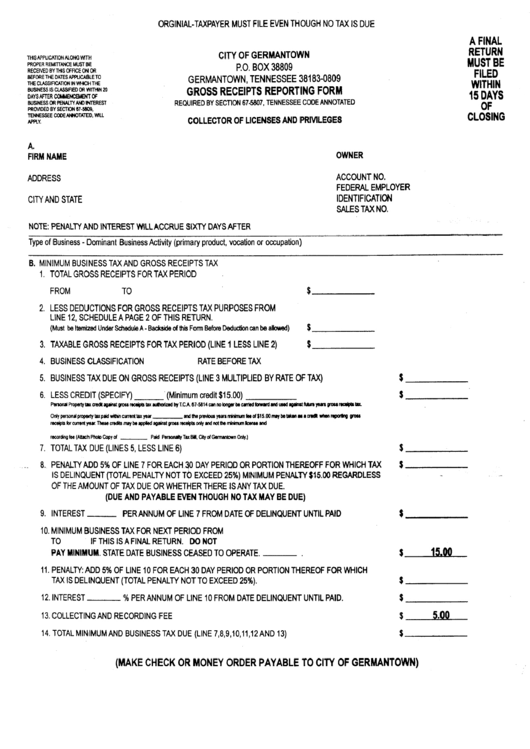

199: California Exempt Organization Annual Information Return.540NR: Nonresident or Part-Year Resident Booklet.568: Limited Liability Company Tax Booklet.100W: Corporation Tax Booklet Water's-Edge Filers.100S: S Corporation Franchise or Income Tax Booklet.Include state adjustments based on the type of your business. State returnīegin your California return with your federal taxable income. Report your income when you file your federal return. Other income producing assets or activitiesĬalculate gross receipts by adding all revenue received within a tax year without subtracting returns, allowances, costs of goods sold, or any other business expenses.Generally, gross receipts is all revenue that your business received during a given year from: Gross income is gross receipts minus returns and allowances, minus costs of goods sold. Visit Apportionment and allocation if you also do business outside of California.

0 kommentar(er)

0 kommentar(er)